29+ long term mortgage rate lock

Lock Rates For 90 Days While You Research. Web Building takes a long time and rising interest rates could make your dream home unaffordable.

Sept 29 Covina Bowl Del Rio Lanes

You may be able to.

. Web Are you looking for a mortgage advisor or do you want to chat about your mortgage scenario. The borrower pays a fee for the option to lower the. Dont Settle Save By Choosing The Lowest Rate.

Save Time Money. Web Our Extended Rate Protection program options offer you the best of both worlds long-term rate lock protection up to 270 days with the ability to float down to a lower rate at any. Ad With the Power of RateShield You Can Protect Your Self in a Rising Rate Environment.

Use CCMs extended rate lock program to lock your rate for up to 12. Web Heres what their rate lock float down option may look like. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Protect Yourself From a Rise in Rates. Web A Long-Term Rate Lock protects you from changes in the market. It is an agreement with your lender that they will honor a specific rate for an agreed upon period of time.

I am licensed in all 50 States for all your needs mortgage advice. Learn More About RateShield Today. There are longer rate lock periods up to 120-days that would require.

The rate lock for the mortgage is 425 for 30 years. Web In our latest whitepaper How to Successfully Hedge a Mortgage Pipeline of Long-Term Interest Rate Locks we will begin with a thorough explanation of fallout pull. Web The rate lock fee may be a flat fee a percentage of the total mortgage amount or added into the interest rate you lock in.

When you lock the interest rate youre protected from rate increases due to market conditions. Web How a Mortgage Rate Lock Works - SmartAsset Loading Savings Connect FDIC Insured APY 270 100 Get Details 360 Performance Savings FDIC Insured APY. Web Typically you can lock in a rate for a period between 30 days to 60 days without a charge.

If rates go down prior to your. Ad With the Power of RateShield You Can Protect Your Self in a Rising Rate Environment. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Learn More About RateShield Today. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days. The fees may be refundable or non.

Web We will extend your rate lock at no cost to you. Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified time. Protect Yourself From a Rise in Rates.

Madison Messenger July 3rd 2022

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

When To Lock In A Mortgage Rate Zillow

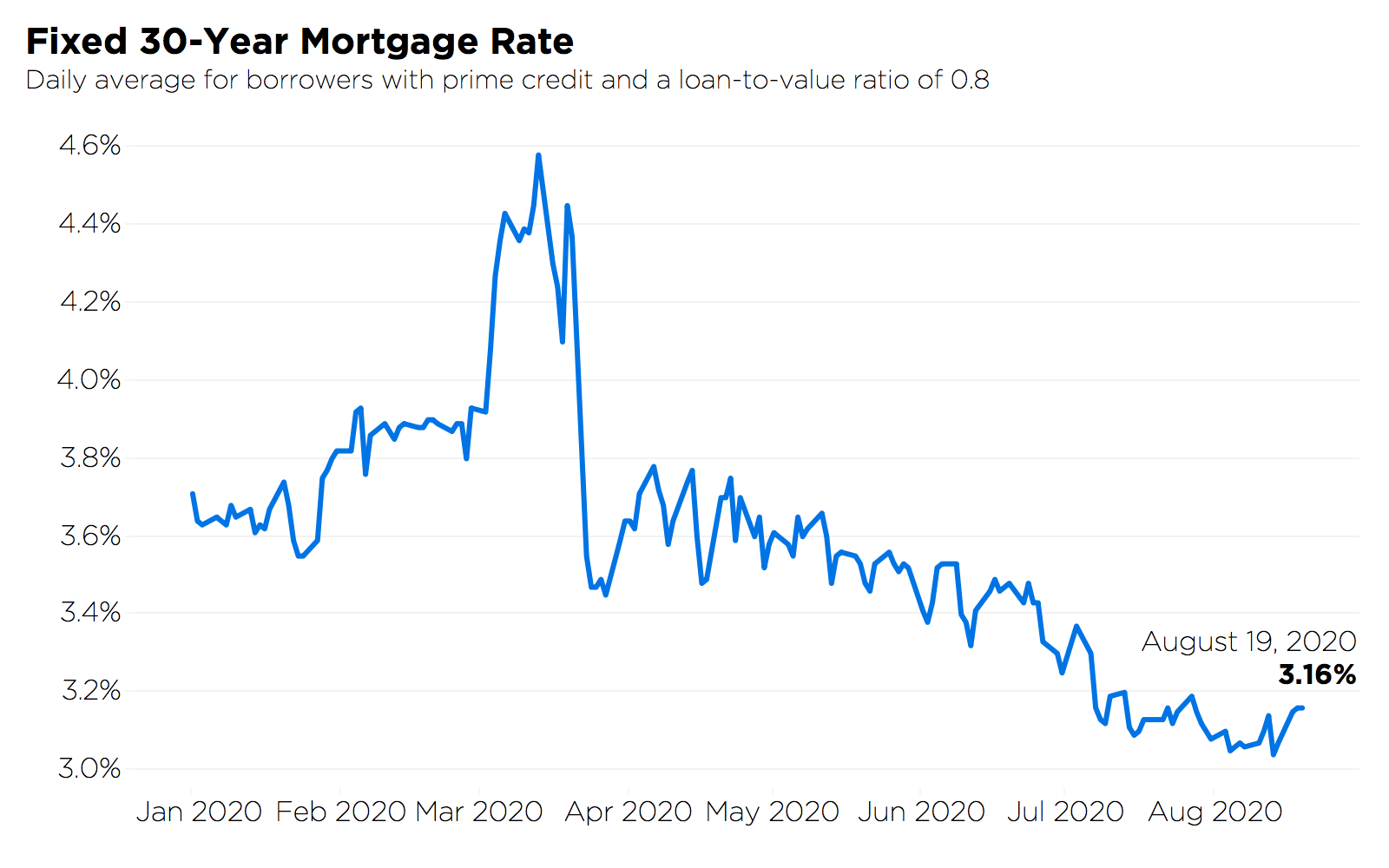

Mortgage Rates Are At Record Lows Here S What That Means For You Zillow Group

Why It S Super Important To Lock Your Mortgage Rate

When Mortgage Rate Locks Expire Mortgages The New York Times

When To Lock In A Mortgage Interest Rate Integrity First Lending

Jesko Von Werthern Page 3 Taunus Bikepacking

Madison Messenger May 29th 2022

Mortgage Rate Locks Everything You Need To Know Prevu

How Long Can You Lock In A Mortgage Rate Rate Lock Guide

Compare Current Mortgage Rates Interest Com

Pdf Evaluation Of The Igg Antibody Response To Sars Cov 2 Infection And Performance Of A Lateral Flow Immunoassay Cross Sectional And Longitudinal Analysis Over 11 Months

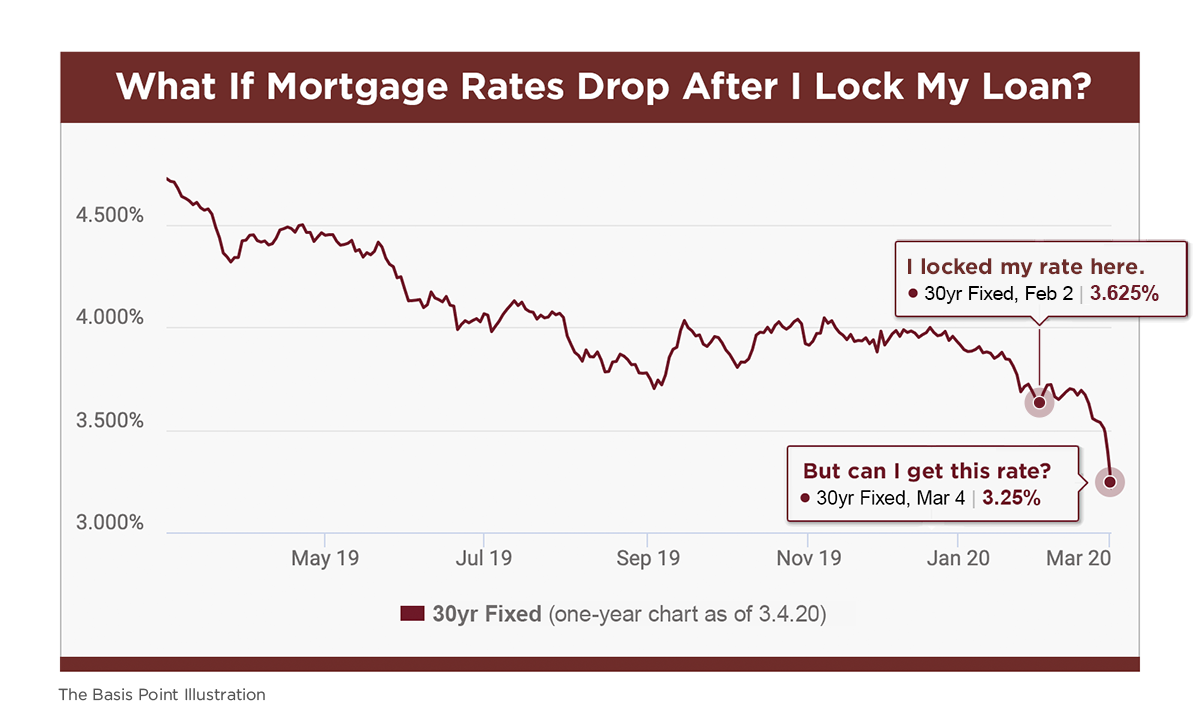

What If Mortgage Rates Drop After I Lock My Loan The Basis Point

Panaracer Fat B Nimble 29 Semi Fat Reifen 29x3 0 76 622 Faltbar 62 90

Judgement S Wow Classic Alliance Leveling Guide 1 60 Warcraft Tavern

When Should I Lock My Mortgage Rate Mortgage Rates Mortgage News And Strategy The Mortgage Reports